Ministry of Labor and Social Development prerequisites the registration for the foreigners operating as accountants and monetary occupants for membership and official registration from the Saudi Organization for Certified Public Accountants (SOCPA).

Recently, the Saudi organization for Certified Public Accountants has reported and made it compulsory that every Saudi expat working in the accounting, finance, and other related professions ought to get registered under SOCPA by submitting and checking their academic documents and relevant accreditations.

The SOCPA fees are classified as follows:

First Time Registration Fees

The Saudi foreigners obtaining registered underneath the SOCPA for the first time need to submit online all their needed documents as well as their relevant educational documents and certifications. The Fees for the first time registration is SAR eight hundred.

Renewal Fees for SOCPA

A fee is needed for the renewal of SOCPA membership by those that are already registered under SOCPA is SAR three hundred.

Professions required to register under SOCPA

- Director of the financial reports department.

- Director of financial and accounting affairs.

- Director of the Zakat & tax department.

- Director of Internal auditing department.

- Chief of Internal auditing programs.

- Financial Controller.

- Director of G.A of reviewing.

- Internal auditor.

- Accounts Technician General.

- Auditor, accounts.

- Senior Financial Auditor.

- Manager of Accounts and Budget.

- Financial Auditing Supervisor.

- Accounts auditing technician.

- Cost accounting technician.

- Finance Clerk.

- General Accountant.

- Cost Accountant.

- Cost Clerk.

YOU MAY ALSO LIKE TO READ “MUQEEM VISA VALIDITY CHECK SERVICE KSA”

Requirements for Registration

- Bachelor’s degree or higher qualification in accounting.

- Post-secondary accounting credentials.

- A graduate of one of the departments of administrative sciences and passed a minimum of fifteen academic hours in accounting, however, those who do not meet the above mentioned fifteen academic hours are needed to:

- Attend accounting, auditing, Zakat, and tax fellowship courses which, all together, are equivalent to nine academic hours

- Complete required hours bypassing topics equivalent to (15) hours in accounting or auditing at one of the recognized universities.

4. Holds one of the following professional certificates:

a) American Institute of Certified Public Accountants (AICPA).

b) Institute of Chartered Accountants in England and Wales (ICAEW).

c) Institute of Chartered Accountants of Canada (CICA).

d) Institute of Chartered Accountants in Australia (CA-Australia).

e) Association of Chartered Certified Accountants in London, UK (ACCA).

f) Institute of Chartered Accountants of Pakistan (ICAP).

g) The Institute of Chartered Accountants of India (ICAI).

h) Institute of Management Accountants (IMA) of the United States of America (CMA).

i) Institute of Certified Internal Auditors (IIA) in the United States of America (CIA).

YOU MAY ALSO LIKE TO READ “EXIT/rE-ENTRY VISA SAUDI ARABIA RULES”

Procedure to register with the SOCPA

Step:1 Go to the website, by following the link. After clicking the link you can access the SOCPA online services. As you click the link, you will see a new screen, press the New User Button.

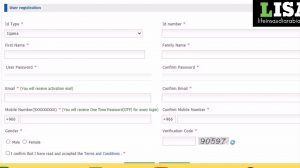

Step:2 As you click the “NEW USER Button”, a new page will appear which will require User registration. Here you are required to fill in the information mentioned in this screen to proceed further and get your User Name and Login ID.

Step:3 Once all the required details have been filled, the Login ID and Password will be sent to the email address that you have added in Step 2.

Step:4 After receiving the email for activation, click that activation link, and after clicking you will see a message which will direct you to click here for login.

Step:5 Following this step, you should click the link for the login. After clicking you will see a new page. On the new page, you are required to enter the Iqama Number which you need to fill in order to proceed further.

Step:6 Once you have put the Iqama Number, then you will receive a verification code on the mobile number you provided.

Step:7 After entering the verification code, you will see a new page where you need to click on the Membership “Request Button”.

Step:8 After selecting the “Membership Request”, you will see a new page where you are required to select one of the educational documents or certificates that you possess for the purpose of getting registered under SOCPA.

Step:9 After selecting the degree or the relevant certificate that you hold, you should click the “Next” and then you will see a new page as mentioned below.

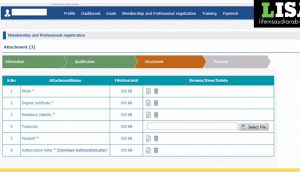

Here, you are required to upload the documents as mentioned below:

- Your Photo,

- Copy of Degree or Certification,

- Copy of Iqama,

- Copy of Passport,

- Copy of Transcript,

- Copy of Authorization letter

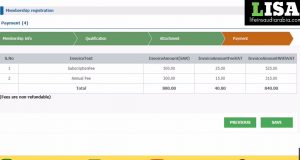

Step:10 Once you uploaded the above-mentioned documents, you need should press the “NEXT” button, a new screen will appear, and you will see the amount of SOCPA Membership fee that you need to pay.

Here you will see the option to pay the fee through online credit card transactions or debit cards.

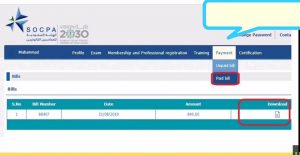

Step:11 Once the fee has paid, you can click on the payment and then select the “Paid Bill”option from the drop-down menu. you will get the invoice in order to submit the invoice to your employer.

I have worked for several years in Saudi Arabia as an expatriate. So I know how dificult it is to manage all the documents and formalities for a common worker in KSA. This is reason I started to write all these articles to help expats in KSA. I hope you enjoy my content.